Governance & Taxation: Rethinking Competitiveness of Sialkot- ECOSF, IRP and University of Sialkot jointly organized the virtual session during Innovation Summit- Sialkot 2021

Go Back

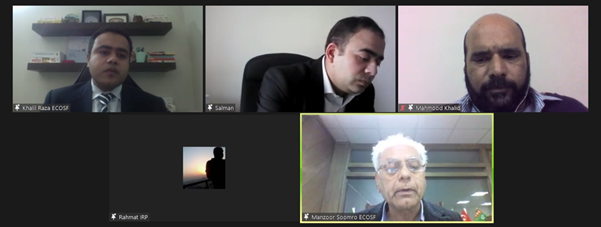

ECOSF in collaboration with Institute of Research Promotion (IRP) and University of Sialkot organized a virtual session on “Governance & Taxation: Rethinking Competitiveness of Sialkot” on March 24, 2021 during the Innovation Summit Sialkot 2021. The session brought together renowned public policy and taxation experts who deliberated talks on measures to improve competitiveness of Sialkot (an export oriented industrial city of Pakistan) through effective governance and taxation framework. Engr. Khalil Raza Scientific Officer ECOSF was the session organizer and moderator.

ECOSF in collaboration with Institute of Research Promotion (IRP) and University of Sialkot organized a virtual session on “Governance & Taxation: Rethinking Competitiveness of Sialkot” on March 24, 2021 during the Innovation Summit Sialkot 2021. The session brought together renowned public policy and taxation experts who deliberated talks on measures to improve competitiveness of Sialkot (an export oriented industrial city of Pakistan) through effective governance and taxation framework. Engr. Khalil Raza Scientific Officer ECOSF was the session organizer and moderator.

The focus of this session was to demonstrate the strengths of Sialkot as a model important economic and industrial hub city of the country. Through exports, Sialkot-based small and medium industries are earning foreign exchange amounting to more than $2.5 billion annually to strengthen the national exchequer.

Mr. Rahmat Ullah, Executive Director - Institute of Research Promotion (IRP) in his presentation highlighted the productive role of Research and Development (R&D) tax incentives which have become important policy instrument for product and process improvement. He underlined the significant need for cross collaboration amongst the government, academia and industry which is essential to boost market competitiveness through effective R&D tax mechanisms.

Dr. Mehmood Khalid, Senior Research Economist at Pakistan Institute of Development Economist (PIDE) emphasized that the government should facilitate the investors to invest in new projects as well as in the expansion of existing industrial concerns to help promote industrialization in the country. Dr. Khalid recommended for simplifying filing requirements, tax codes to reduce compliance cost that could help boost the revenue collection and inclusive growth. He further said that excessive documentation and compliance requirements serve as barriers to improve taxation and negatively affect the economic activities. He also said that distinction between a filer and a non-filer through rate differential has not been worked well in Pakistan. Rather, it has established a premium for being a non-filer!

Mr. Muhammad Salman Aslam Dar, Strategic Investment Analyst, Investment Climate Reform Unit underscored that Sialkot has a great potential to achieve tremendous growth with adequate governance and tax incentives especially for the local businesses in Sialkot. He said such interventions could also be replicated in other cities of Pakistan. Mr. Dar proposed some interventions for improving competitiveness for Sialkot, which could further boost the innovation and exports in the country. In order to achieve these objectives, a strong collaboration amongst major institutions and stakeholders is the key, he concluded.